Supply Chain Resilience: an approach to tackle disruptions for organizations

Introduction

In an ever-changing environment, organizations are more likely to experience a wide range of unpredictable risks, causing minor to major disruptions throughout their Supply Chain (SC). For organizations it is necessary to recognize this and to reflect on their own SC rather than their competitors; while policymakers should reconsider strategies for making global value chains more resilient.

The current Ukraine conflict and COVID-19 pandemic are just the latest disruptions to global SCs. For instance, in 2011 a major earthquake and a subsequent tsunami in Japan shut down factories producing electronic components for cars, thus interrupting assembly lines worldwide. The disaster knocked out the world’s top producer of advanced silicon wafers, on which many semiconductor companies relied. In 2017, Hurricane Harvey raged through the states of Texas and Louisiana, disrupting some of the largest US oil refineries and petrochemical plants, thereby creating shortages of key plastics and resins for a range of industries.

All of these events are clearly more than just a 'run of bad luck' and organizations cannot simply ignore them. While focusing on the value chains that produce manufactured goods, this article explores the main sectors more frequently affected by SC disruptions and explains the main points of measure that should be considered while evaluating resilience throughout a SC. The article also presents a short case study that explains how technology could become a key player in enhancing resilience within the SC.

Risks for Supply Chains

By analyzing the potential shocks that could affect the SC, several threats could be considered, including force majeure events (such as natural disasters), macropolitical shocks, financial crises, as well as the work of malicious actors and terrorist attacks, all of which affect the worldwide scene.

Considering the risk perception and appetite of organizations, it is interesting to observe the annual Allianz Global Corporate & Specialty Report, the “Allianz Risk Barometer 2022” (Table 1), which identifies the most important corporate perils for the next 12 months[1]. In the ranking, cyber incidents, business interruptions and natural disasters are the top three business risks globally in 2022. On the other hand, even if the pandemic still occupies a high position in the rank, it has fallen to fourth position as the majority of companies are less concerned and feel adequately prepared for future outbreaks. Extreme weather events have brought organizations to increase their risk perception toward natural catastrophes and climate change (which are inevitably connected). Finally, risks related to market changes, macroeconomic developments and political violence will probably rise significantly as well, considering the possible impacts of energy shortages, negative spillovers and elevated uncertainty for organizations these days.

Table 1 The first ten positions of the 10th annual Allianz Risk Barometer survey conducted among Allianz customers (global businesses)

However, while the source of a shock is relevant in order to value it, it is also important to understand its length, the effects it generates across geographies and industries, and whether a shock affects only the supply side or also the demand side of the market. Indeed, disruptions vary based on their severity, frequency and lead time. Moreover, on the basis of the operational choices of an organization, there could be more vulnerabilities. For instance, just-in-time policies, sourcing from a single supplier and relying on customized inputs with few substitutes, amplify the extent of a disruption caused by external shocks. Geographic concentration in supply networks can be a major vulnerability as well. Considering this, organizations need to start thinking about a new resilient approach, which takes into account all the possible vulnerabilities applicable to their operational choices.

Sectors Exposed to Supply Chain Disruptions

The analysis on value chains producing manufactured goods in different sectors shows that trade intensity is a relevant factor, since heavily traded value chains are more exposed to disruptions than those with lower trade intensity. Some of these include highly requested value chains, such as communication equipment, semiconductors and components, computers and electronics. They also have the characteristic of being high value and concentrated, underlining potential threats for the global economy. For instance, the apparel sector is highly exposed to pandemic risk, heat stress and flood risk, since it is a heavily traded labor-intensive value chain. On the other hand, value chains focused on rubber and plastics, food and beverage, glass, cement and metals have a lower exposure to disruptions since these value chains are within the least exchanged and mostly located regionally. At the moment, pharmaceutical products are also one of the least exposed compared to other industries for the same reasons. However, such a situation might be threatened by trade tensions, as well as possible regulatory changes in the case of safeguards applied to public health. Finally, the food and beverage and the agriculture sectors are going to be increasingly exposed to shocks since these value chains are facing climate-related issues.

Non-Financial KPIs for Measuring SC Resilience

In this context, building resilience is an important factor for organizations, in order to be prepared to face unpredicted changes in the environment with proactive and reactive actions. Therefore, best practices suggest using Key Performance Indicators (KPIs) to monitor internal and external organizational performances and help decision making.

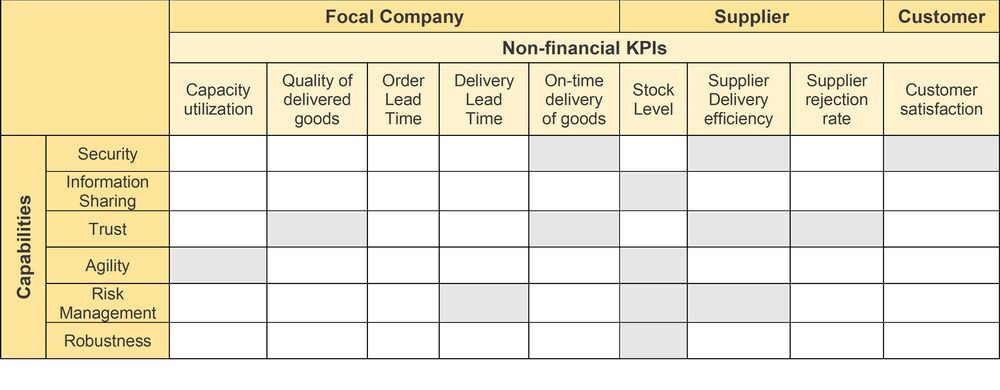

Considering all the phases of a disruption (pre-disruption, during-disruption and post-disruption), the non-financial KPIs are associated with the following capabilities:

- Security can be measured by a variety of metrics such as on-time delivery, which can help to predict future shocks by monitoring the delay and immediately searching for the root causes. Moreover, the result of this KPI also influences the level of customer satisfaction and it can also check customer satisfaction around security, thus deciding if there is a need for developing new practices to enhance security. Another metric that can help develop security is supplier delivery efficiency, which is revealed by monitoring the on-time delivery of materials.

- Information sharing is the first step in achieving visibility and can help top management to mitigate and overcome shocks. Monitoring the supplier and customer stock level can help to avoid or mitigate the bullwhip effect, allowing upstream and downstream visibility through information sharing about organizational assets. For instance, an organization can share information on new project development or online order status.

- Trust is considered an important element in developing resilience and it is provided by strong connections between organizations. In this regard, the quality of delivered goods and on-time delivered products are KPIs that improve this element, considering that it increases the level of confidence of customers in an organization. Supplier delivery efficiency can also help to measure the supplier’s reliability in delivering materials. Finally, since inaccurate delivery greatly reduces the confidence of customers towards the company, supplier rejection rate is a KPI that can help with monitoring trust.

- Agility refers to the ability to rapidly respond to changes, which reduces the impact of disruptions and enhances the response time. Capacity utilization and stock level are the right KPIs to monitor responsiveness towards customer demands. This is particularly important in the case of disruptions, considering that there might already be surplus capacity to meet the urgent requirements.

- Risk management can help reduce vulnerabilities through forecasting, monitoring and mitigating potential risks. Monitoring the stock level can help managers to mitigate risk and reduce inventory costs. Risks can also be mitigated by observing the delivery lead time, a customer service KPI which gives feedback to control the day-by-day operations. Supplier delivery efficiency is also seen as a KPI fit for risk monitoring, since it observes drops in supplier performance and consequent possible disruptions in the flow of goods.

- Robustness measures the ability of the supply chain to support impacts arising from different disruptions or maintaining continuity of the process. In this regard, the stock level is an appropriate KPI in preparing the company for major and unavoidable breaks. Sometimes an alternative to achieving robustness is to create redundancy of resources in the supply chain. Indeed, turbulent periods have taught us that holding extra resources is a key strategy for companies in overcoming critical situations caused by supply disruptions.

Table 2 Non-Financial KPIs for measuring SC Resilience

As observed in Table 2, all non-financial KPIs can influence the creation of SC Resilience in all three phases of a disruption. Thus, organizations can make use of them to monitor operations and manage resources so as to overcome any disruptive event that might happen. Building SC resilience can take many forms, such as strengthening risk management capabilities, improving transparency, building redundancy in supplier and transportation networks, increasing warehouse stock or reducing product complexity.

Independently from the different capabilities that could be addressed based on the organization’s needs, it is always convenient to work on building resilience. Indeed, statistics demonstrates that companies can expect to lose more than 40%[2] of a year's profits every decade on average due to disruptions, therefore resilience measures could more than pay off for companies, workers and broader societies over the long term.

SC Resilience: Case Study in the Food Supply Ecosystem

To achieve resilience maturity in the SC, digitalization has a key role since it leads to a more insightful decision-making process. In this regard, technology in the food industry has achieved a critical role, providing granular and timely information and increasing visibility through the whole SC. In particular, one of the greatest challenges of this new era is represented by the implementation of the open-source, vendor-neutral Blockchain, especially effective in offering trust, immutability and transparency for the entire food supply ecosystem. This solution suits the food industry because of its decentralized, shared databases, used by many parties such as suppliers or direct competitors. To really understand the revolution that has been achieved through Blockchain, it is useful to present one of the first pilot projects implemented by Walmart for tracing the origin of mangos sold in its US stores.

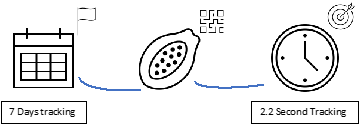

The leader of the Walmart marketing division bought a packet of sliced mangoes at a nearby Walmart store and asked his team to identify which farm they had come from as fast as possible. The team started contacting distributors and suppliers and had an answer seven days later. This was not bad by industry standards, but Walmart wanted to do much better. Therefore, together with IBM, they got to work by building a Blockchain-based food traceability system. The Walmart Technology team looked at their own processes, as well as those of their suppliers, in order to design the application and define the data attributes to be uploaded on the Blockchain, while IBM wrote the chaincode. Suppliers used new labels and uploaded their data through a web-based interface. As a result, the blockchain-based food traceability system built for the mangoes reduced the time needed to trace their provenance from 7 days to 2.2 seconds!

Image 1 Representation of the time needed to trace the mangoes before and after

Walmart now traces over 25 products from 5 different suppliers using Blockchain technology, having proved that it can reduce the amount of time it takes to track a food item from a Walmart store back to source in seconds, as compared to days or even weeks.

Conclusion

The increasing frequency of supply-driven disruptions will continue to destabilize global value chains, causing different types of issues which vary based on their severity, frequency and lead time. Supply-chain resilience and a mindset of continuous adaptation are required to navigate near-term uncertainty and strengthen competitive advantages in the long term. Organizations need to put the enhancement of supply chain resilience at the core of corporate strategic priorities and monitor internal and external organizational performances to help decision-making. In this regard, digitalization has a key role. Initiatives to drive digitalization and supply chain resilience should use data to increase visibility and insight, leveraging collaboration among many parties such as suppliers and direct competitors.

[1] Based on the insight of 2,769 risk management experts from 92 countries and territories

[2] McKinsey report “Risk, resilience, and rebalancing in global value chains” based on a model informed by the financials of 325 companies across 13 industries